Advertisement

BOLNews Photos

BOLNews Photos

BOLNews Photos

BOLNews Photos

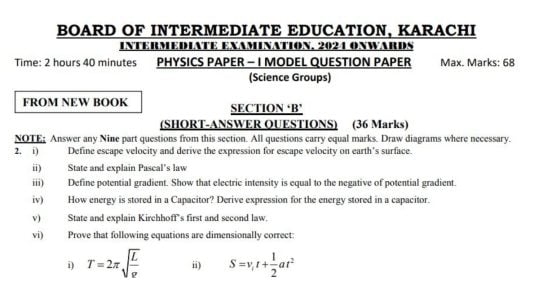

Pakistan

Advertisement

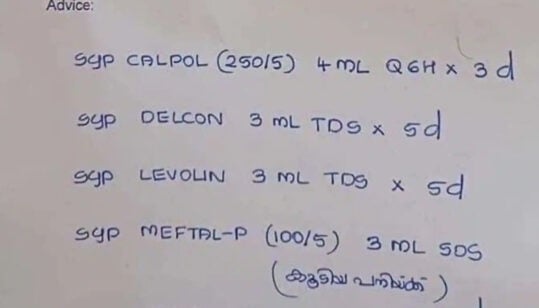

Coronavirus

Advertisement

Life & Style

HEALTH & FITNESS

Fashion

Relationship

Beauty

Parenting

Books

Travels

Work Life

Islam

Visual Stories

Advertisement